Past Bank Conference Events

"Under the Radar" - the Virtual Bank Conference Where Banks and Investors Come Together to Explore Opportunities

November 8th & 9th, 2023 - Under the Radar Keynote Speakers

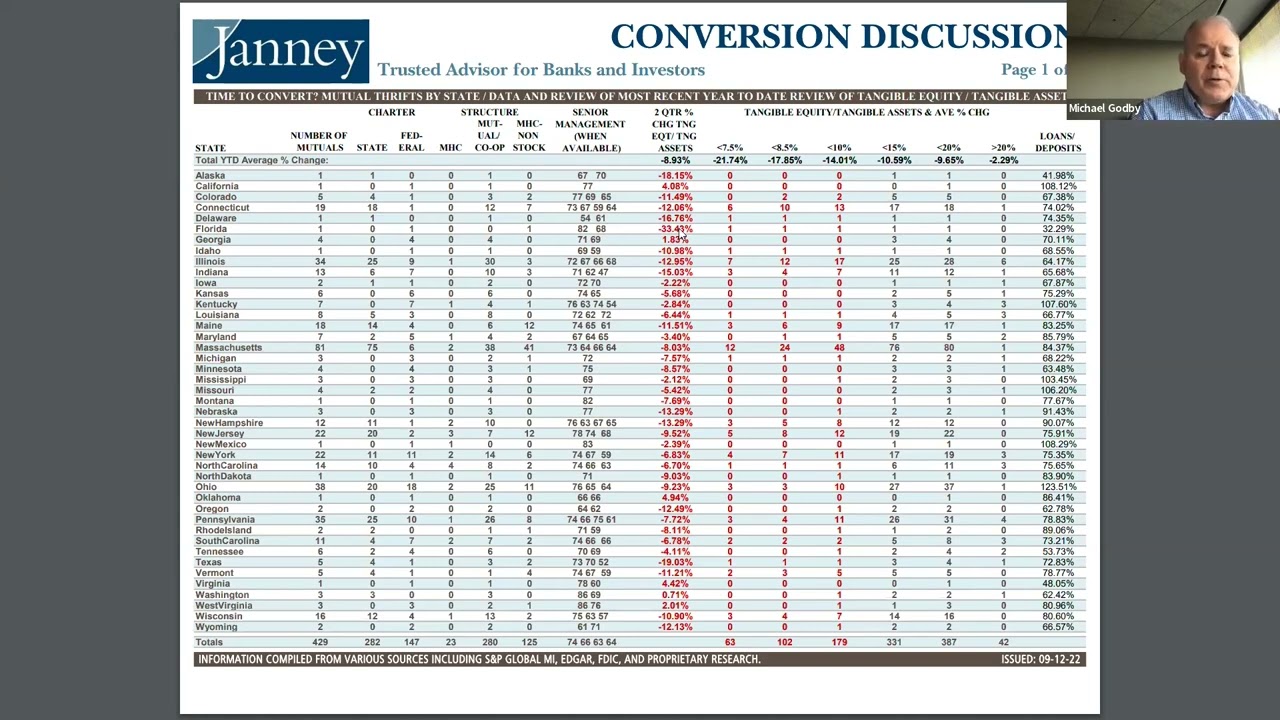

Mike Godby

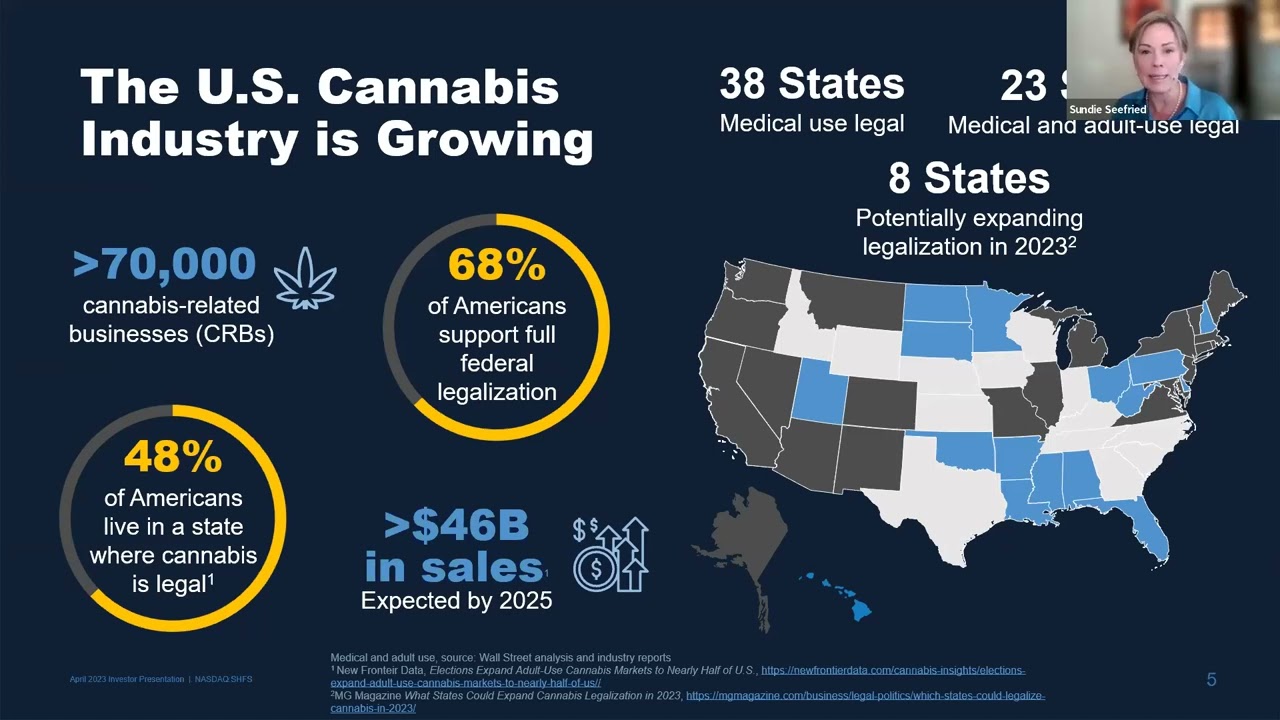

Sundie Seefried

Now in its 8th year, Safe Harbor has grown to nearly 600 accounts spanning 20 states, and processed over $12 billion in cannabis-related transactions. Presentation

Video can’t be displayed

This video is not available.

Video can’t be displayed

This video is not available.

Presenting Banks Presentations & At-a-Glance Stats

Video can’t be displayed

This video is not available.

Bankwell Financial Group, Inc. - BWFG

Video can’t be displayed

This video is not available.

SR Bancorp, Inc. - SRBK

California Clarification (Mini)Conference

March 29, 2023

Keynote Speakers:

Simone Lagomarsino

Recent events in the banking industry, and her thoughts regarding possible changes in banking regulation, and her projections regarding interest rates, the California Economy including real estate, population growth, and bank M&A Bank and leadership.

Mike Scarpa

Mike Scarpa will address the following topics:Interest Rate Risk/Asset Liability Management, Liquidity Risk Management, Contingency Funding Planning, FDIC assessment basics, and potential areas of risk management and regulatory compliance that may change in light of what’s happened.

Bank Presenters:

Summit State Bank (SSBI) Brian Reed, CEOCamille Kazarian, CFO

Bank of San Francisco (BSFO) Ed Obuchowski, CEO & FounderWendy Ross, President & FounderJennifer Corr, CFOFelix Miranda, Commercial Banking Manager

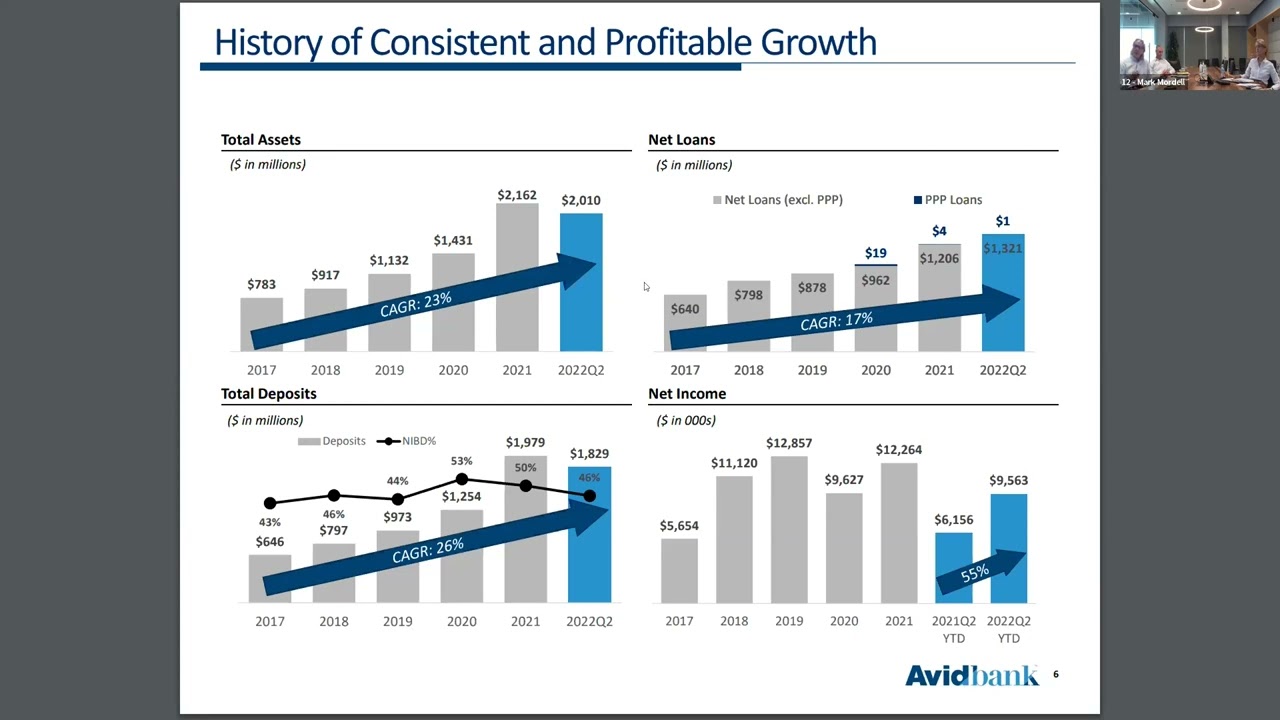

Avidbank Holdings, Inc. (AVBH) Mark Mordell, CEO

Endeavor Bancorp (EDVR) Dan Yates, CEO Steven Sefton, President

Credit Unions And M&A Tuesday, December 6, 2022

He provides strategic advice primarily to depository financial institutions throughout United States.Derek has significant experience working with credit unions and mutual savings banks. This includes capital planning within the credit union and mutual structures, the conversion process where merited (including both credit union to mutual and mutual to stock company), and post-conversion capital management

Before re-joining Sandler O’Neill in 2004, Szot was co-founder and principal of Y-Merge, which was acquired by SNL Financial (S&P Global). He originally joined Sandler O’Neill in 1993.Szot is a graduate of both the Wharton School of the University of Pennsylvania and Columbia University.

September 13, 2022 - Under the Radar Keynote Speakers:

Mike Godby

Video can’t be displayed

This video is not available.

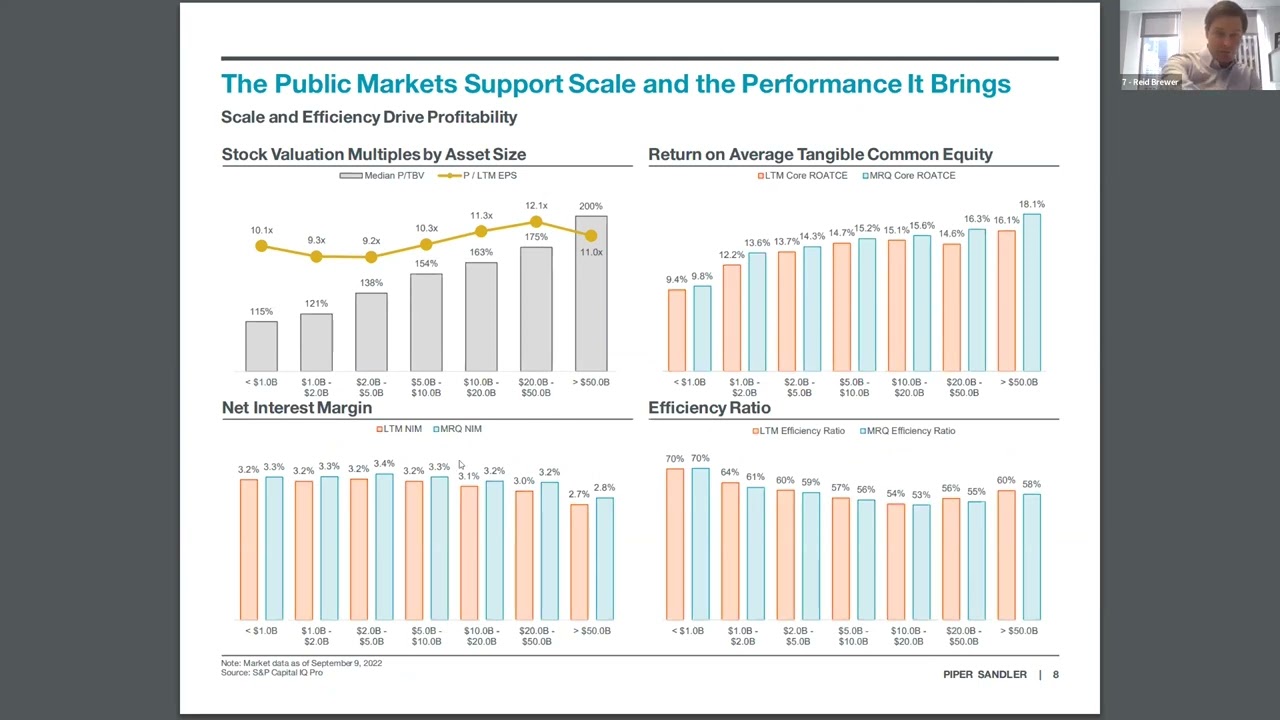

Reid Brewer

Topic: Mergers & acquisitions in an age of securities markdowns

Video can’t be displayed

This video is not available.

Bank Presenters:

September 2022 Bank Presentations

Video can’t be displayed

This video is not available.

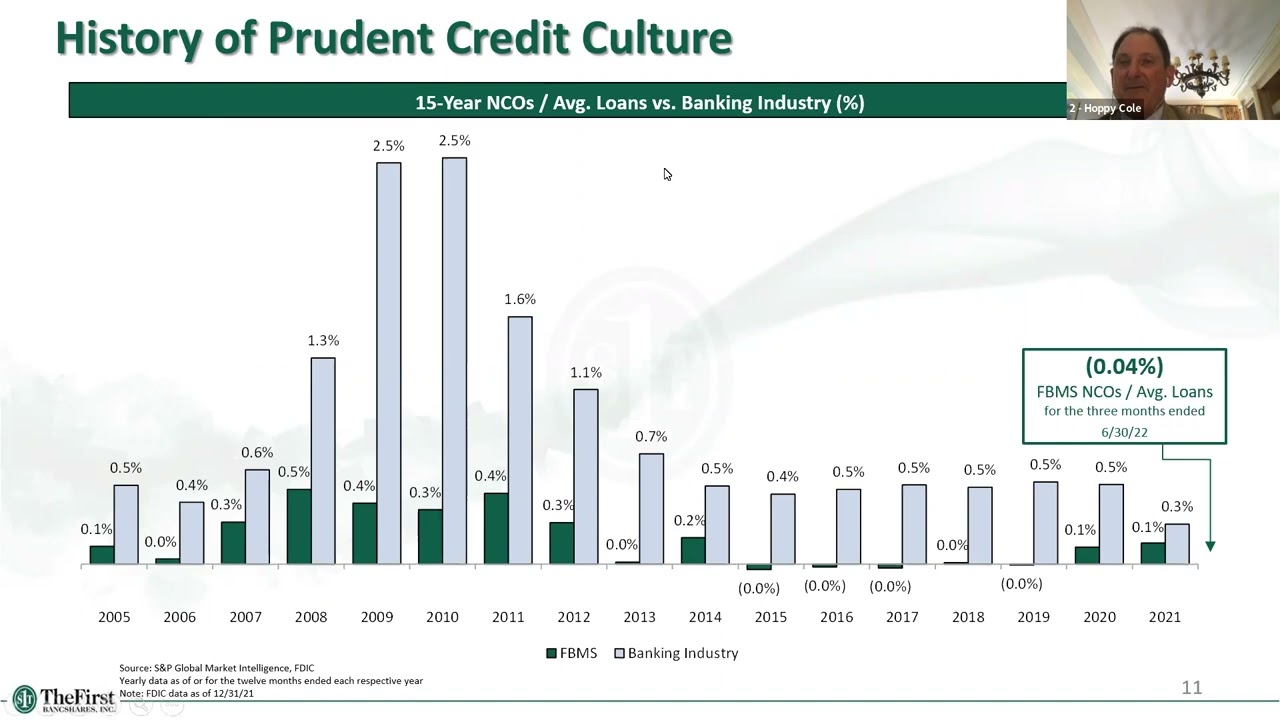

FBMS

Video can’t be displayed

This video is not available.

FFIC

Video can’t be displayed

This video is not available.

LCNB

Video can’t be displayed

This video is not available.

MGYR

Video can’t be displayed

This video is not available.

WRIV

Video can’t be displayed

This video is not available.

PBBK

Video can’t be displayed

This video is not available.

PDLB

Video can’t be displayed

This video is not available.

LBNW

Video can’t be displayed

This video is not available.

AVBH

Bankwell Financial Group, Inc. (BWFG) is a high-performance bank with a valuable deposit franchise in Fairfield County, CT, and a strong board of directors trading at 1.12x tangible book.

The First Bancshares, Inc. (FBMS) acquired Heritage Southeast Bancorporation (HSBI) after HSBI terminated its sale to a credit union; an opportunity for HSBI shareholders to get to know FBMS better.

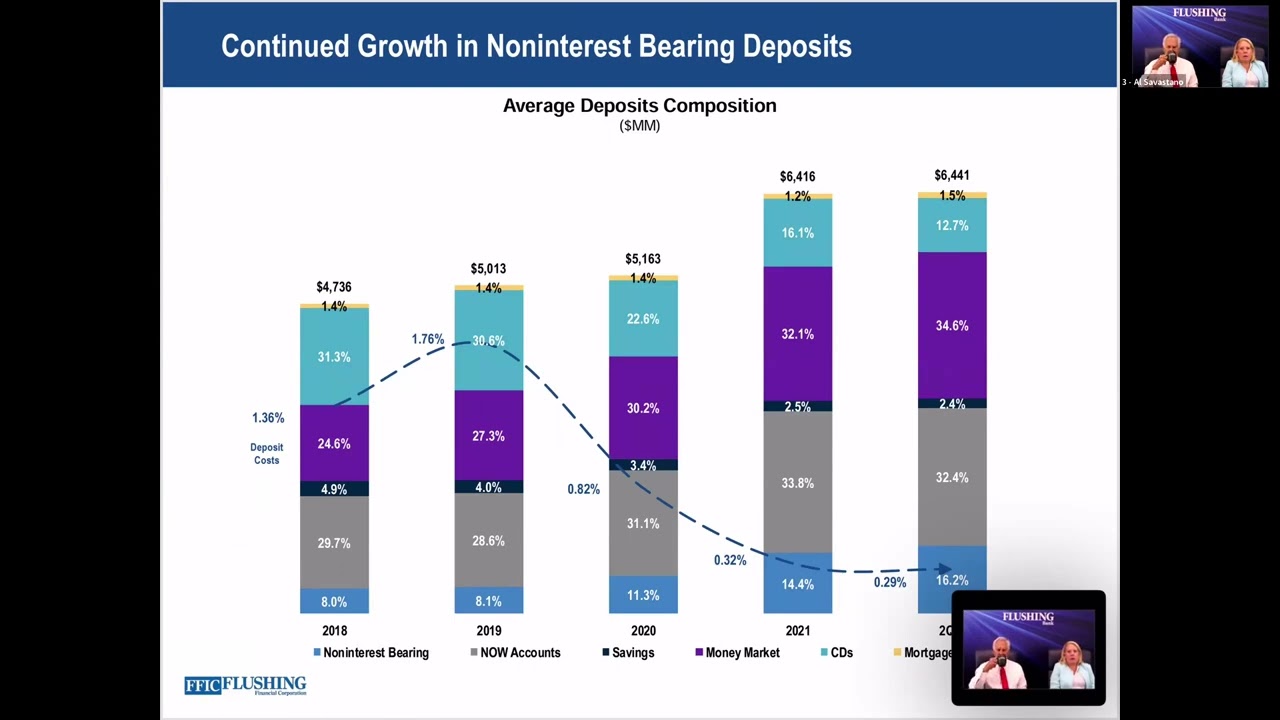

Flushing Financial (FFIC) is a $6.4B metro-NY deposit franchise trading around TBV with interesting growth initiatives in Fintech and local niche markets.

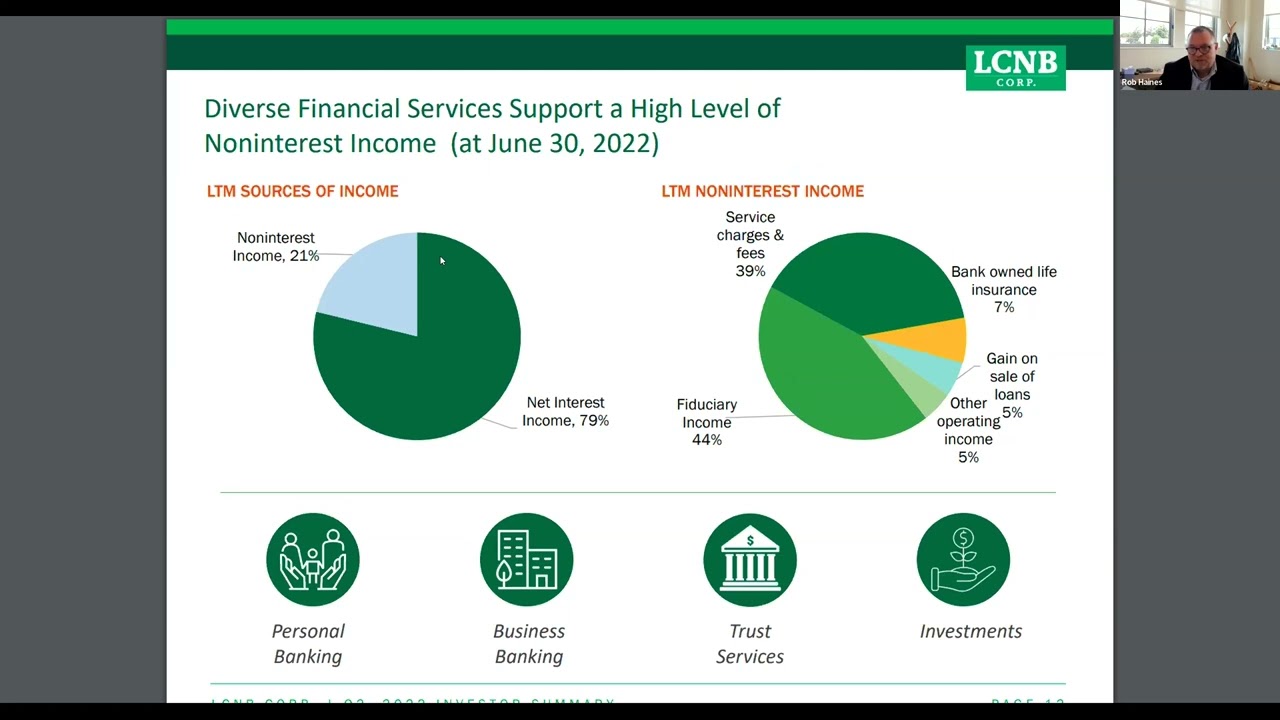

LCNB Corp. (LCNB) is one of the strongest deposit franchises in one of the strongest midwest markets with one of the strongest dividend yields. Liberty Northwest Bancorp, Inc. (LBNW) is a de novo bank with a strong deposit base in the attractive Seattle MSA market that just listed its stock on the OTCQX market.

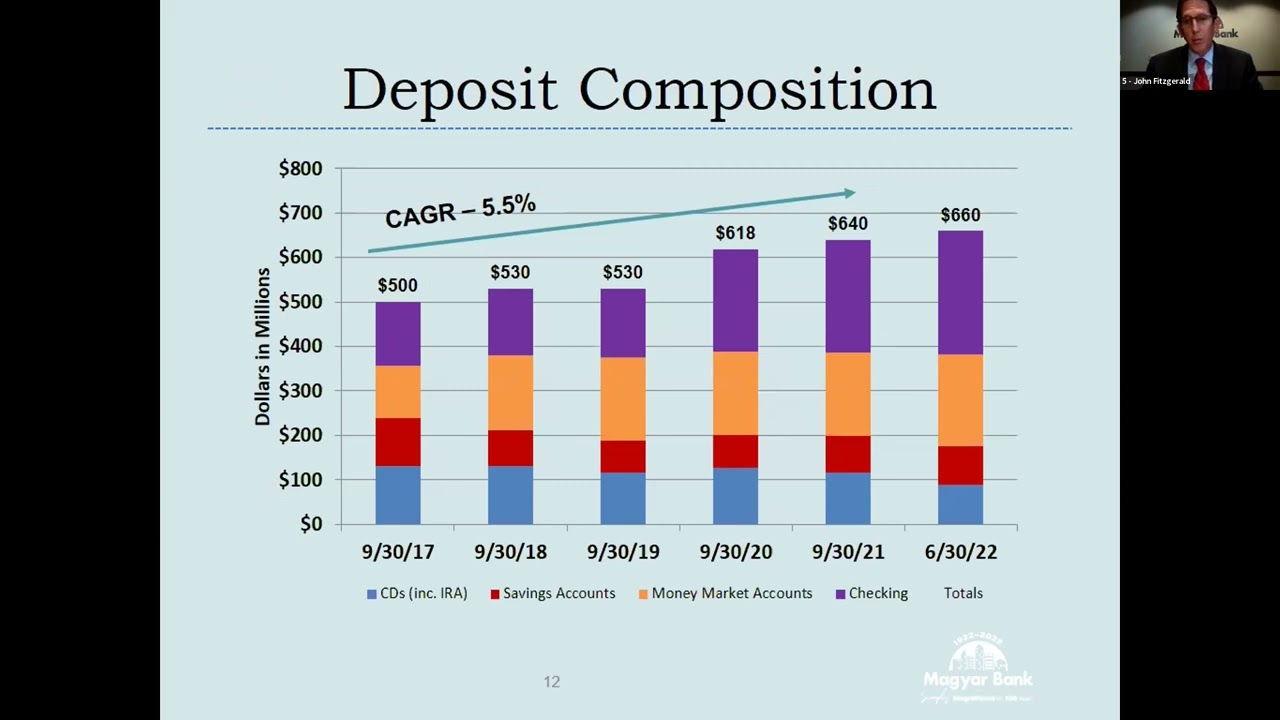

Magyar Bancorp, Inc. (MGYR) is a recent thrift conversion selling at a discount to tangible book just past its 1-year anniversary with a special dividend, regular dividend, and a 5% share repurchase authorization already under its belt.

PB Bankshares (PBBK) is a recent thrift conversion selling well-below TBV that just passed its one-year anniversary with a 10% buyback authorization. Ponce Financial Group, Inc. (PDLB) - recent 2nd step conversion trading below offer price and below tang book even adjusted for fintech exposure with excess capital and a track record of accretive capital management. White River Bancshares Co (WRIV) is a growth bank with strong deposits in attractive northern AR market trading at 1x tangible book, an opportunity to get an update on recent investments and growth opportunities in an "under the radar" part of the country.

June 8, 2021 - Under the Radar

Keynote Speakers:

June 8, 2021 Conference Agenda

IntroductionKeynote Speaker: Mike GodbyPhilly Area Bank: William Penn Bancorp (WMPN) - Ken Stephon, President & CEO

Midwest Bank Panel: FFBW, Inc. (FFBW) - Edward Schaefer, President & CEOFirst Savings Financial (FSFG) - Tony Schoen, CFO

Strong Deposit Franchises: Eagle Bank of Montana (EBMT) - Peter Johnson, President & CEOSalisbury Bancorp (SAL) - Richard Cantele, President & CEOWhite River Bancshares (WRIV) - Scott Sandlin, Chief Strategy Officer

CapStar Financial (CSTR) - Denis Duncan, CFO

East Coast Opportunities: ES Bancshares (ESBS) - Philip Guarnieri, CEOPartners Bancorp (PTRS) - Lloyd Harrison, CEO

West Coast Banks:Bank of San Francisco (BSFO) - Edward Obuchowski, CEORiverview Bancorp (RVSB) - David Lam, CFOSaviBank (SVVB) - Mike Cann, Chairman & CEO

Keynote Speaker: Joey Warmenhoven

Community Banks with Fintech: First Northwest Bancorp (FNWB) - Matt Deines, President & CEO Provident Bancorp (PVBC) - Carol Houle, CFO

MHC Panel:PDL Community Bancorp (PDLB) - Carlos Naudon, President & CEOPioneer Bancorp (PBFS) - Tom Amell, President & CEO

Non-Public Emerging Banks: Liberty Bank (Seattle Area) - Rick Darrow, CEONew Valley Bank & Trust (Massachusetts) - Jeff Sullivan, CEO >> Download June 8 Virtual Bank Conference Data Spreadsheet (PDF)